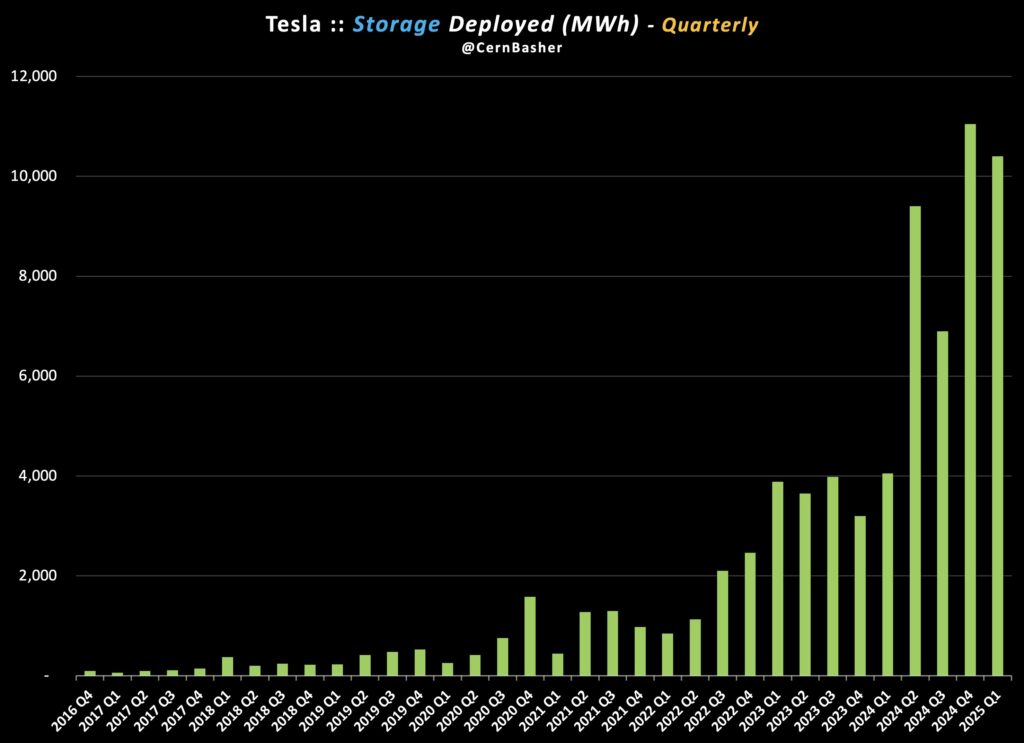

Tesla’s energy division has quietly emerged as a powerhouse, posting remarkable growth this quarter while Wall Street remains fixated on the company’s automotive business. Despite Tesla Energy’s explosive trajectory deploying 10.4 GWh of energy storage in Q1 2025, a 156% year over year increase analysts and investors seem to be missing the forest for the trees. This oversight is a critical misstep, as Tesla Energy is poised to redefine the company’s revenue mix and profitability. In our view, the tipping point for analyst price targets will come when energy surpasses approximately 20% of Tesla’s total revenue, a milestone that could arrive sooner than many expect if current growth rates hold. Here’s why Tesla Energy is being underestimated, how it’s growing so fast, and why it’s a boon for customers, all underscored by the strategic brilliance of the new Shanghai Megafactory.

Tesla Energy’s Meteoric Rise and Wall Street’s Blind Spot

Tesla Energy’s revenue and deployments are surging, yet the narrative around Tesla remains stubbornly car centric. In Q1 2024, Tesla deployed 4.1 GWh of energy storage with revenue of $1.64 billion. Fast forward to Q1 2025, and deployments have skyrocketed to 10.4 GWh a growth rate of approximately 150% year over year. While exact Q1 2025 revenue figures aren’t yet public, if we assume a similar revenue to deployment ratio as last year (around $400 per MWh), Tesla Energy could have pulled in over $4 billion this quarter alone. Compare that to Tesla’s total revenue of $97.69 billion in 2024, and energy’s contribution is climbing fast.

Wall Street’s analyst price targets, however, remain anchored to vehicle deliveries and automotive margins, which dipped to 13.6% in Q4 2024 amid a competitive EV market. Meanwhile, Tesla Energy boasts gross margins exceeding 20% with Q3 2024 hitting a record 30.5% outpacing the car business significantly. This profitability gap highlights a fundamental miscalculation: Tesla is no longer just an automaker it’s a sustainable energy juggernaut, and the energy division is where the real growth story lies.

When Will Energy Hit 20% of Revenue?

Let’s crunch the numbers. If Tesla Energy maintains its 150% year over year growth rate a reasonable assumption given the ramp up of the Shanghai Megafactory and sustained global demand here’s how it could play out. Assuming Q1 2025 energy revenue reached $4 billion, annualizing that (a simplistic but illustrative approach) suggests $16 billion for 2025. At 150% growth, 2026 could see $40 billion in energy revenue. Tesla’s total revenue has grown more modestly 0.95% from 2023 to 2024 but let’s optimistically project 10% annual growth from 2024’s $97.69 billion base. That puts total revenue at $107.46 billion in 2025 and $118.2 billion in 2026.

- 2025: $16 billion (energy) / $107.46 billion (total) = ~14.9%

- 2026: $40 billion (energy) / $118.2 billion (total) = ~33.8%

If these trends hold, Tesla Energy could exceed 20% of total revenue by mid 2026, possibly even sooner if automotive growth slows or energy accelerates further. This tipping point will force analysts to recalibrate their models, likely pushing price targets higher as they assign greater value to Tesla’s high margin energy business.

Why Tesla Energy Is Growing So Fast

Tesla Energy’s growth isn’t an accident, it’s the result of strategic foresight and market tailwinds. First, global demand for energy storage is exploding as grids transition to renewables. Solar and wind are intermittent, and Tesla’s Powerwall and Megapack solutions store excess energy for use when the sun isn’t shining or the wind isn’t blowing. In Q1 2025 alone, Tesla’s 10.4 GWh deployment reflects this insatiable appetite, dwarfing the 4.1 GWh from Q1 2024.

Second, the new Shanghai Megafactory, which began trial production in late 2024 and is ramping up for mass production in Q1 2025, is a game changer. With an initial capacity of 10,000 Megapacks annually (40 GWh), it doubles Tesla’s global energy storage output alongside the Lathrop, California facility. Unlike car factories, energy factories are far simpler to build, no complex assembly lines for seats, doors, or suspensions, just battery packs and inverters. This streamlined construction enabled Tesla to complete Shanghai in under a year, showcasing the company’s signature “Tesla speed.” With China’s robust battery supply chain and Tesla’s partnership with suppliers like CATL and BYD’s FinDreams, production costs are plummeting, fueling both growth and margins.

Finally, Tesla’s energy products are supply constrained, not demand constrained. CEO Elon Musk has long predicted that energy storage would outpace automotive growth, and Q1 2025’s numbers prove he’s right. As new factories come online, Tesla is finally catching up to the backlog of orders from utilities, businesses, and homeowners.

Customer Benefits: Powering Homes and Grids

For customers, Tesla Energy delivers tangible value. The Powerwall, now in its third iteration, allows homeowners to store solar energy, slash electricity bills, and maintain power during outages—a critical perk as climate driven blackouts rise. Each Megapack, capable of storing over 3.9 MWh, can power 3,600 homes for an hour, making it a lifeline for utilities stabilizing grids. Unlike gas peaker plants, Megapacks are clean, quiet, and require minimal maintenance, offering a 20-year warranty and over-the-air updates that improve performance over time. Businesses and governments, like the Shanghai Lingang Economic Development Group (the factory’s first customer), are snapping them up to meet sustainability goals and cut costs.

Energy Margins Trump Cars and Factories Are Easier to Build

Here’s where Tesla Energy shines: profitability. While automotive margins hover around 13-17% (excluding credits), energy margins consistently exceed 20%, with Q3 2024’s 30.5% setting a benchmark. Why? Fewer moving parts, lower labor costs, and a scalable design that leverages Tesla’s battery expertise. Cars require intricate supply chains and precision engineering; energy storage is more straightforward, relying on batteries and software two areas where Tesla excels.

Building an energy factory is also far less daunting than a car factory. Giga Shanghai’s car plant took a year to construct in 2019, a feat hailed as remarkable. The Shanghai Megafactory? Seven months from groundbreaking to trial production. Without the “bells and whistles” of automotive assembly think paint shops, stamping presses, or crash test facilities energy factories are leaner, cheaper, and faster to scale. This ease of expansion means Tesla can flood the market with Megapacks!