The market may have overreacted, but Tesla’s future has never looked brighter.

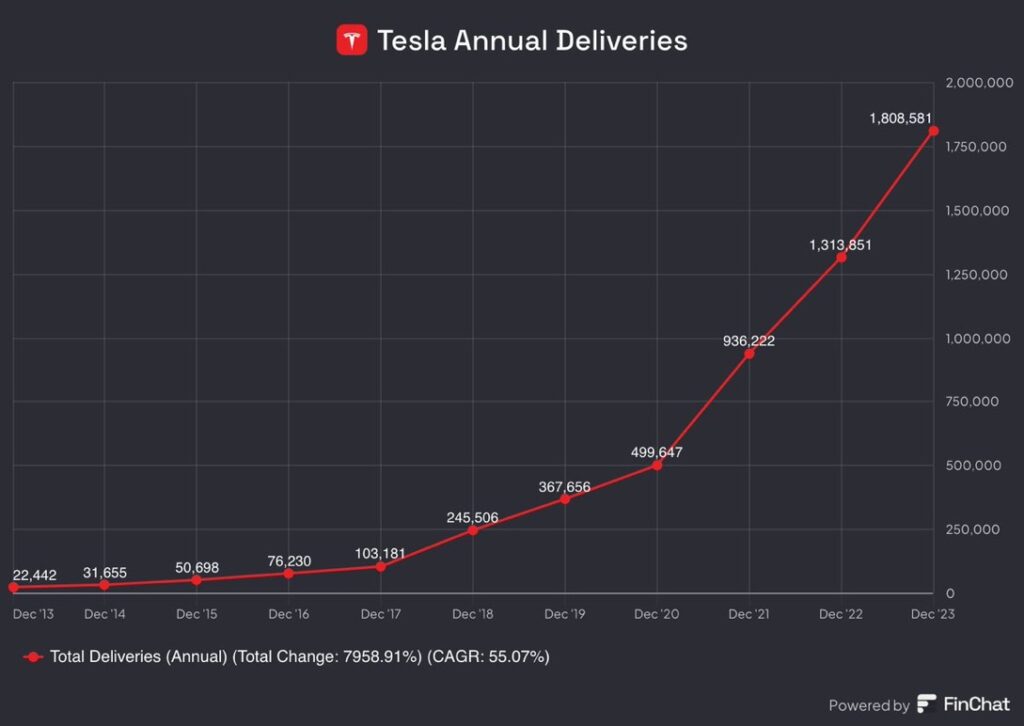

The numbers are in: Tesla just delivered an astounding 495,000 vehicles in Q4 2024. While shy of the ambitious 500,000-target, this marks yet another record-breaking quarter for the EV leader. But instead of celebrating, the market reacted with a 6% dip in Tesla’s stock price. Let’s unpack what happened and why this might just be the perfect buying opportunity.

The Headlines vs. Reality

Missing a target, no matter how ambitious, often triggers knee jerk reactions from investors. But let’s not forget: 495,000 vehicles is a record an achievement most automakers can only dream of. Tesla isn’t just pushing cars out the door, it’s dominating the EV landscape and reshaping the industry.

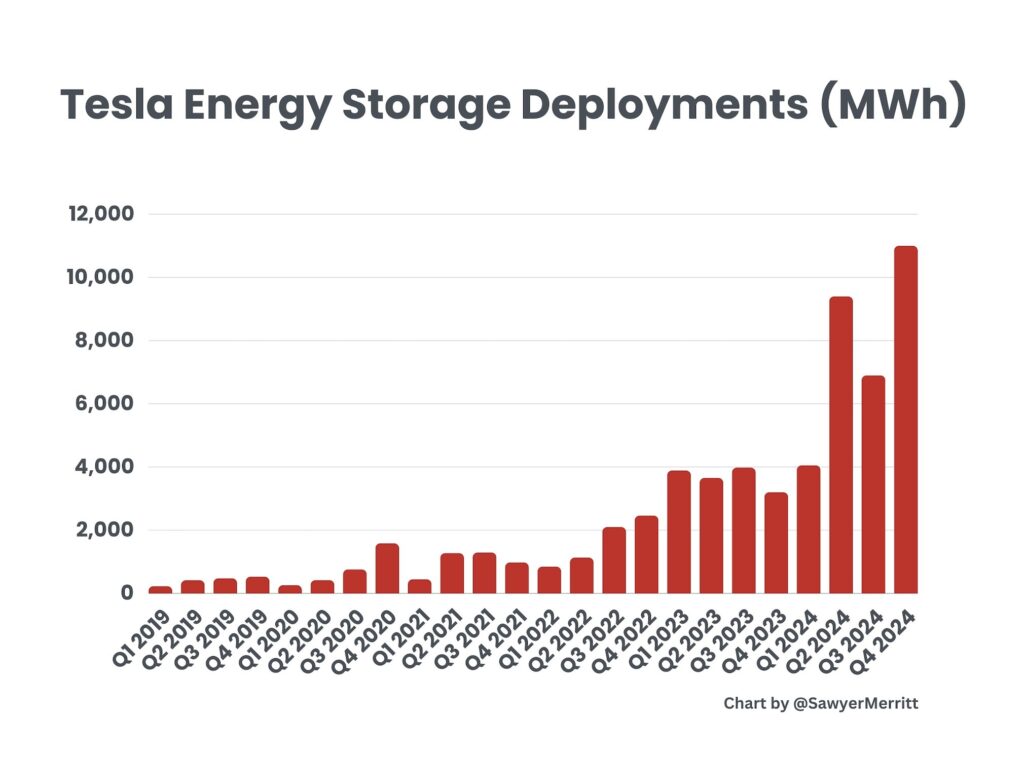

And here’s the kicker: Tesla Energy delivered 31.4 GWh of energy storage this quarter. That’s enough to power small cities, shatter its own records, and prove that Tesla is so much more than a car company.

From residential Powerwalls to industrial scale Megapacks, Tesla is revolutionizing the grid. Every Megapack sold not only generates revenue but also strengthens Tesla’s position as a leader in sustainable energy.

Tesla delivered a record 495,000 vehicles in Q4 2024, just shy of the 500k target. The result? A 6% dip in the stock market. But here’s the truth: Tesla is on fire (in a good way).

Its a signal of a company firing on all cylinders and future proofing itself against any market volatility.

Let’s not forget software. FSD 13 is making headlines for its game-changing capabilities, with drivers reporting hours of autonomous trips without a single intervention. Tesla is closing in on a world where cars truly drive themselves.

As for Optimus? Let’s not even go there for now. But rest assured, Tesla’s humanoid robot will someday add another zero to the company’s market cap. This is an opportunity.

At TeslaImpact, we’re not just following the news we’re shaping the conversation. Join us as we explore the future of sustainable innovation.